How to Determin Which to Use S Corporation or Llc

If the transferor is a grantor trust or LLC solely owned by a C corporation not doing business in Oregon or a nonresident individual check the appropriate box. Use this form only if the transferor is an individual.

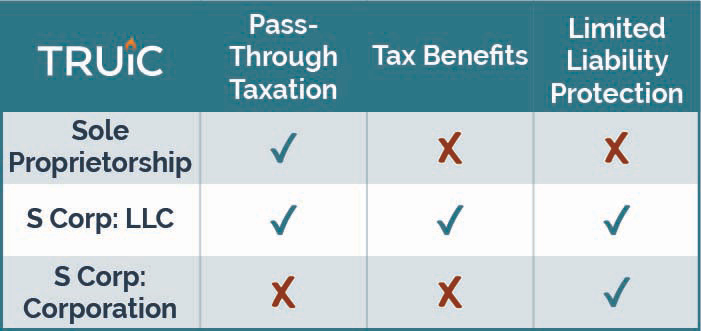

Sole Proprietorship Vs S Corp Which Is Best Truic

Complete this form using the owners information not the information of the grantor trust or single member LLC because those entities are disregarded for tax purposes.

S Corp Vs Llc Difference Between Llc And S Corp Truic

S Corp Vs Llc Difference Between Llc And S Corp Truic

Comments

Post a Comment